Be Your Own Boss

Become Mutual Fund Distributor Proven Way to Boost Income

Become Mutual Fund Distributor

Investing in mutual funds requires a comprehensive understanding of the market, and with the abundance of information available online, investors can easily compare different funds before making their decisions. Despite this, the role of a mutual fund agent remains crucial in helping investors navigate through various options and make informed choices. These agents, or distributors, are vital to the growth and development of the mutual fund business in India.

To know how to become mf distributor with Imperial Money, it is essential to understand the entire process, starting with clearing the NISM Certification examination and setting up your business. This journey ensures that you meet the highest standards of knowledge, attitude, and ethics, positioning you as a trusted advisor in the financial market. As a mutual fund distributor, you will facilitate the buying and selling of mutual fund units between Asset Management Companies (AMCs) and investors, earning commissions for each investor you bring on board. These help build your career as well as strengthen the mutual fund business ecosystem.

At Imperial Money, we support you every step of the way in becoming a successful mutual fund distributor. By partnering with us, you gain access to a wealth of resources, training, and guidance to help you excel in this field. Whether you are an individual or a firm, being licensed by the Association of Mutual Funds in India (AMFI) allows you to provide valuable market advice and assist investors in selecting the most suitable mutual fund schemes.

If you are planning to become mutual fund agent, Imperial Money gives you the right platform to start your journey in the mutual fund business. Join us today and become mf Distributor to embark on a rewarding career in the financial sector.

Get Started

Let’s get in touch to start your journey to become Mutual Fund Distributor.

Kindly fill the form with required details or simply call / email us.

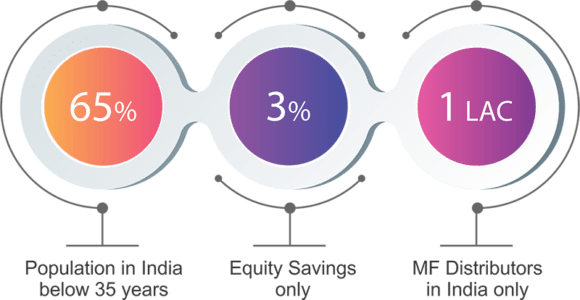

Opportunity for Our Partners

- Training

- S. S. S. Approach - Salability, Scalabilty, Systems

- Unique Marketing Strategies ( IAPs, Branding, Storytelling etc)

- Reviews, Flyers daily 1 ( via what’s app for across all the products in auto mode)

- Social Media Unique Strategies ( Specific is Terrific)

- Referral program

- Management Information System

- Professional Handholding Program ( Imperial SHIFU)

- Client Engagement Program ( Imperial ZEN )

MSRR Formula

IMPERIAL MONEY PARTNER DESK

WHAT OUR PARTNER SAYS ABOUT US

- Imperial Money Partner Testimonial: Mr. Pradeep Gupta- Kolkata

- ----------------------

- Imperial Money Partner Testimonial: Mr. Ganesh Dumbre- Nagpur

- ----------------------

- Imperial Money Partner Testimonial: Mr. S Sankaraanand - Chennai

- ----------------------

- Imperial Money Partner Testimonial: Mr. Anand Tela - Yavatmal

- ----------------------

IMPERIAL MONEY PARTNER DESK

Complete Business Management Platform

FAQ's

A mutual fund distributor is a licensed individual or entity that sells mutual fund products to investors and

provides advice on fund selection. They act as intermediaries between the mutual fund company and the

investors.

To become mf distributor, you need to pass the NISM Series V-A: Mutual Fund Distributors

Certification Examination and register with AMFI (Association of Mutual Funds in India).

The NISM Series V-A: Mutual Fund Distributors Certification Examination is a mandatory certification for

mutual fund distributors in India. It ensures they possess the necessary knowledge of mutual fund

products, regulations, and distribution practices.

To register for the NISM Series V-A certification examination, visit the official NISM website and create an

account, then select the desired exam and complete the registration process by providing necessary

details and making the payment.

Yes, various training programs for the NISM certification exam are available through online platforms,

coaching centers, and official NISM resources.

The fee for the NISM Series V-A exam is ₹1500 plus applicable taxes. Payment can be made online

during the registration process.

Yes, qualifying the relevant NISM certification exam, such as NISM Series V-A, is mandatory to become mutual fund distributor or agent in India, as per SEBI regulations. It demonstrates knowledge and

competency in mutual fund distribution practices.

To apply for an ARN, complete the ARN application form available on the AMFI website and submit it

along with required documents and the fee at the nearest CAMS office.

Documents required for ARN registration include-

1) Proof of identity

2) Proof of address

3) PAN card

4) NISM certification

To maintain your ARN, complete the required Continuing Professional Education (CPE) programs and

ensure timely renewal before the expiration date.

When you become mutual fund distributor, you are offered opportunities to earn commissions through sales, provide financial guidance, and establish credibility in the investment advisory field

Yes, we will help you train for the NISM exam and assist you throughout the process.

Yes, when you become mutual fund distributor, you can distribute funds from multiple Asset Management Companies

(AMCs) after completing the necessary registration and compliance requirements with each AMC.

When you become mf distributor, you typically earn commissions ranging from 0.5% to 1.5% of the invested amount depending on the type of mutual funds and AMC agreements. If you are researching how to become MF agent, understanding commission structures is essential.

Yes, when you become mf distributor, you must adhere to guidelines set by SEBI (Securities and Exchange Board of India), including registration, ongoing training, and investor disclosure norms. This compliance is integral to how to become a mutual fund agent in India.

Yes, when you become mutual fund distributors, you can join associations such as AMFI (Association of Mutual Funds in India) and networks like CAMS to access resources, training, and updates. These networks are valuable for professionals learning how to become mutual fund agent online and offline.

Technology in mutual fund business and mutual fund distribution streamlines processes such as client on boarding, investment

tracking, and providing real-time market updates, enhancing efficiency and customer service. It also

facilitates digital transactions and improves accessibility to investment options for a wider audience.

Yes, senior citizens can become mutual fund distributors by fulfilling the required qualifications and

registration processes set by regulatory authorities, provided they meet the competency and compliance

standards.

To start a mutual fund business as distributor , obtain the necessary certifications such as AMFI Registration

Number (ARN) in India, and build a strong network to attract and advise clients on suitable investment

options.

You must complete the KYC by submitting the documents like, Name, Email Address, Mobile No, ARN

Card, Aadhar, PAN, City, Nominee, Bank Details to our RM. They will take the Empanelment process

further with our operation team. After completing the KYC, our team will give you our app login, and then

you can start transacting immediately.

Once you finish your KYC verification by our operation team, you will be assigned a dedicated

relationship manager. They will help you with sales closures, product research & selection, portfolio

reviews and business growth ideas. Regular training and digital marketing support is provided for your

business growth.

Yes, we are a multi-product platform. You can offer equity, insurance, & Bonds. We will update you about

every new product.

Yes, Once the client is mapped to you, any transaction that the client does will be treated as your

business. You will be eligible to earn a commission on the same.