Imperial Money in GIFT city

Showcasing India’s growth story and unlocking new opportunities for global investors in one of the world’s fastest-growing economies.

I AM INTERESTED

to start a GIFT city investment.

Introduction to GIFT City IFSC

Why IFSC GIFT City

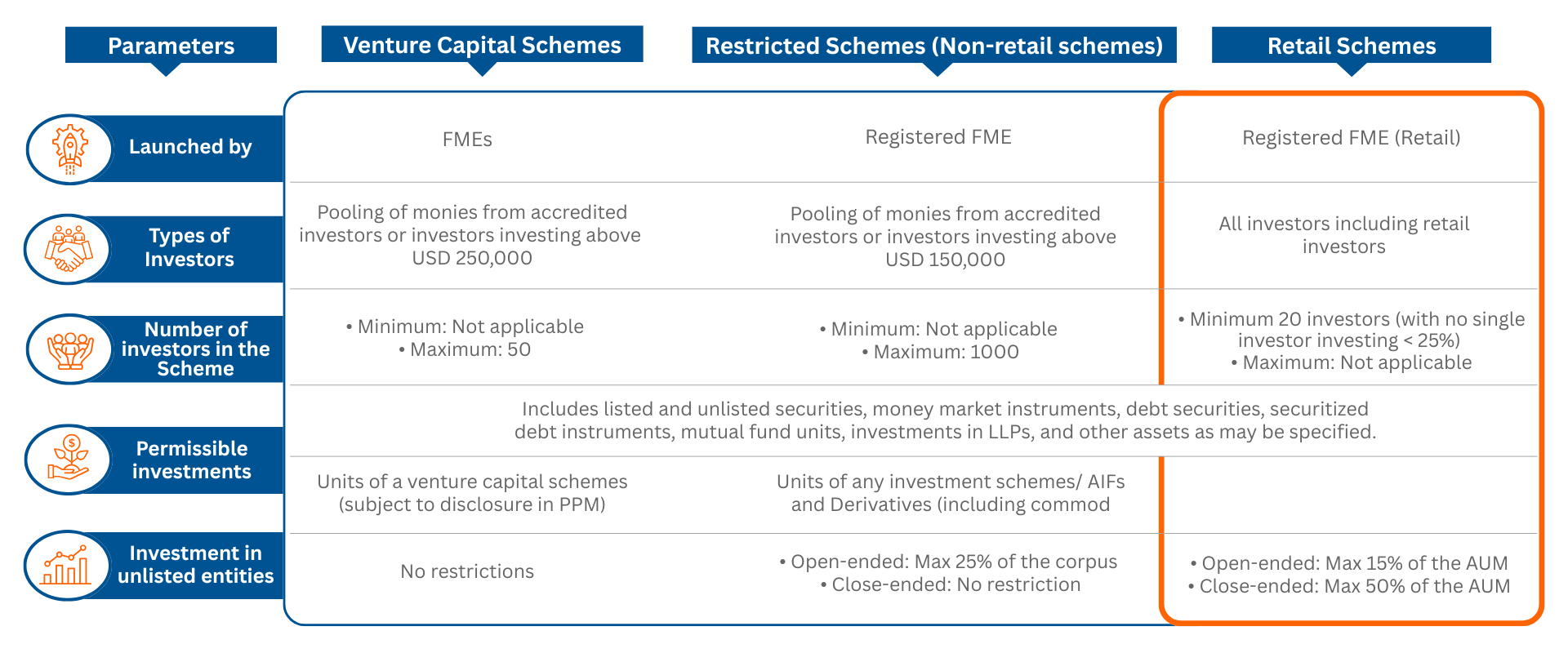

Scheme Categories in GIFT City

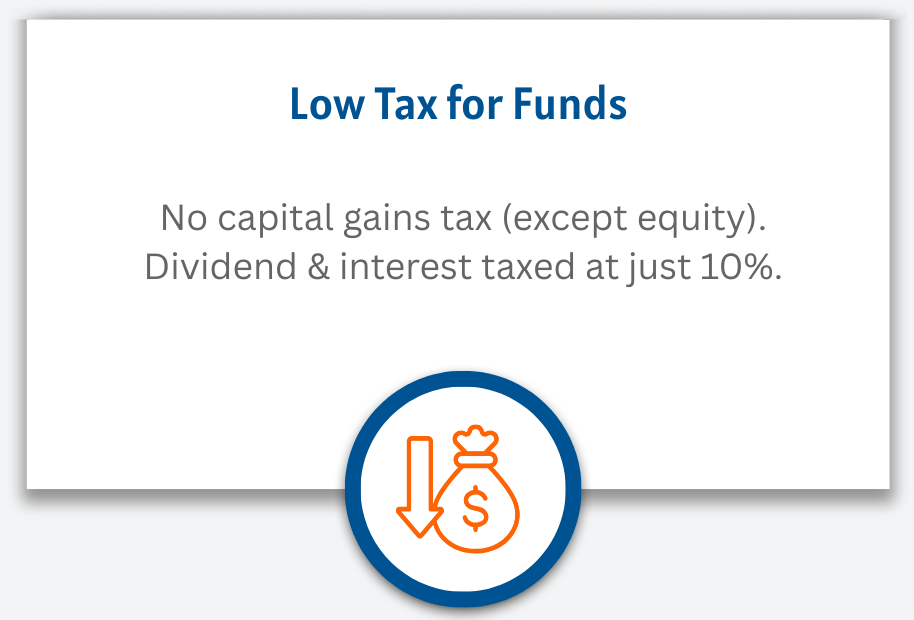

GIFT City Tax Benefits – For Global Investors

Who can Invest

Who Can invest?

- NRIs

-

Foreign Investors

-Individual

-Non-Individual

-All investors from FATF compliant jurisdictions

Who Can Not invest?

- Indian Residents

- Investors from countries on FATF Blacklist, Greylist, or Restricted list

- NRIs and Foreign Investors from the USA & Canada

How to Invest?

GIFT City – FAQs

GIFT City (Gujarat International Finance Tec City) is India’s first international financial services hub, designed to be at par with global financial centres like Singapore, Dubai, and London. It offers world-class infrastructure and a regulatory framework that enables cross-border investments, banking, insurance, funds, and capital market activities.

The idea behind GIFT City is to bring back offshore financial activities which usually take place in Singapore, Dubai, or Mauritius to India. It aims to create a globally competitive financial ecosystem and give investors and businesses an internationally transparent platform that offers Tax Benefits and regulatory advantages.

Gift City India attracts investors with several unique advantages such as:

- Tax incentives for individuals and institutions

- Ease of doing business under a single regulatory framework (IFSCA)

- Access to global products like international equities, bonds, derivatives, and funds

- Robust infrastructure with digital-first systems and global standards

- Opportunity to diversify portfolios while remaining within India’s jurisdiction

The International Financial Services Centres Authority (IFSCA) is the unified regulator for all financial services in Gujarat international finance tec city. It oversees banking, insurance, capital markets, fund management, and fintech activities.

Yes ✅. NRIs and foreign investors can use GIFT City to access Indian as well as global investment opportunities. They benefit from simplified account structures, lower costs, and tax benefits.

Gujarat international finance tec city offers a wide range of products such as:

- Mutual Funds & Alternate Investment Funds (AIFs)

- ETFs, Bonds, and Depository Receipts

- Derivatives and International Equities

- Insurance and Reinsurance products

- Offshore banking services

Indian investors get exposure to global products, can diversify beyond domestic markets, and enjoy tax efficiencies. At the same time, they are transacting within a transparent and regulated Indian environment, reducing reliance on foreign jurisdictions.

Entities and funds operating in GIFT City enjoy:

- Tax holiday on certain incomes for 10 consecutive years out of 15

- No GST on transactions between IFSC entities

- No Securities Transaction Tax (STT) or Commodity Sale Duty (CTT)

- Lower withholding taxes for NRIs

While global centres like Singapore, Dubai, and London are well established hubs, GIFT City is India’s answer with cost competitiveness, favorable regulations, and proximity to Indian investors. Its unique tax and compliance advantages make it an emerging alternative for both Indian and international investors.

At Imperial Money, we help investors and partners explore opportunities in Gujarat International Finance Tec City for products such as mutual funds, AIFs, ETFs, and global investment avenues. Our advisory approach ensures that you not only understand the opportunities but also align them with your long-term financial goals.

A company with high customer satisfaction rate since mid 2011, Imperial Money had engaged in providing comprehensive Financial distribution services to individuals.

Quick Links

Our Services

Get In Touch

India Office -

- 302, Royal Vista, Opp. Dhantoli Garden Main Gate, Dhantoli, Nagpur - 440012

- Office no 2, Stilt floor, Gopalkrishna Apt, CTS no 265, Shirole Lane, Shivajinagar, Pune- 411005

- (+91) 9595 8899 88

- (0712) 2454477

- wecare@imperialfin.com

Canada Office -

- 5 Exhibition Cres, Brampton ON L7A 4B8, Canada

- +1 (905) 782-9408

Imperial Money Pvt. Ltd. makes no warranties or representations, express or implied, on products offered through the platform. It accepts no liability for any damages or losses, however caused, in connection with the use of, or on the reliance of its product or related services. Unless otherwise specified, all returns, expense ratio, NAV, etc are historical and for illustrative purposes only. Future will vary greatly and depends on personal and market circumstances. The information provided by our blog is educational only and is not investment or tax advice.

Mutual fund investments are subject to market risks. Please read all scheme related documents carefully before investing. Past performance of the schemes is neither an indicator nor a guarantee of future performance. Terms and conditions of the website/app are applicable. Privacy policy of the website is applicable.

AMFI Registered Mutual Fund Distributor

ARN-162444 | Date of Initial Registration: 16-04-2019 | Current validity: 31-03-2028

Copyright © 2024 Imperial Money Pvt. Ltd. All rights reserved. Disclaimer | Disclosure | Privacy Policy | T & C | SID/SAI/KIM | Code of Conduct